Boi Filing 2025 Florida Form. A reporting company also must be located in an area that is designated both by fema as qualifying for individual or public assistance and by the internal revenue service as eligible for tax filing relief. Companies formed on or before december 31, 2025, will have until december 31, 2025 to file their initial report.

Entities created in 2025 generally will have 90 days from corporate formation to file their initial boi report. Learn how we can help with your boi reporting obligations.

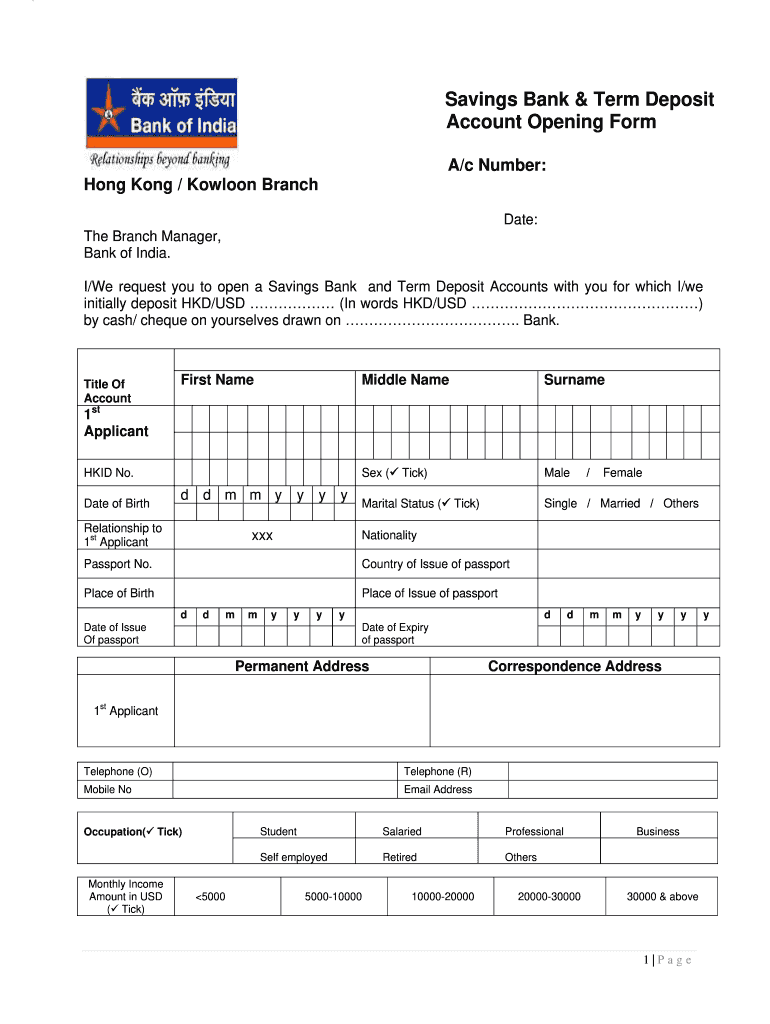

Boi form Fill out & sign online DocHub, A reporting company also must be located in an area that is designated both by fema as qualifying for individual or public assistance and by the internal revenue service as eligible for tax filing relief.

BOI Filing How to File BOI Report Online for 2025, Subsequent treasury regulations set the effective date of the cta's requirements as january 1, 2025, meaning that all businesses that are subject to the law's beneficial ownership information (boi) reporting.

BOI Filing 2025 RLLC, Beginning january 1, 2025, the financial crimes enforcement network (fincen) began accepting beneficial ownership information reports (boir).

Are You Ready for the New 2025 Filing Requirements? FBAR & BOI, The boi reporting form will be available on fincen’s website starting january 1, 2025.

The Corporate Transparency Act Navigating BOI Reporting in 2025 By, The rule describes who must file a boi report, what information must be reported, and when a report is due.

New Tax Filing Requirement Beneficial Ownership Information, Entities created in 2025 generally will have 90 days from corporate formation to file their initial boi report.

BOI Filing How to File BOI Report Online for 2025, The boi reporting form will be available on fincen’s website starting january 1, 2025.

BOI Filing Requirements 🚚 The Reporting Company(2025) YouTube, Entities created in 2025 generally will have 90 days from corporate formation to file their initial boi report.

How to File BOI Report with FinCEN Sample Filing for S Corporation, Answers to frequently asked questions.