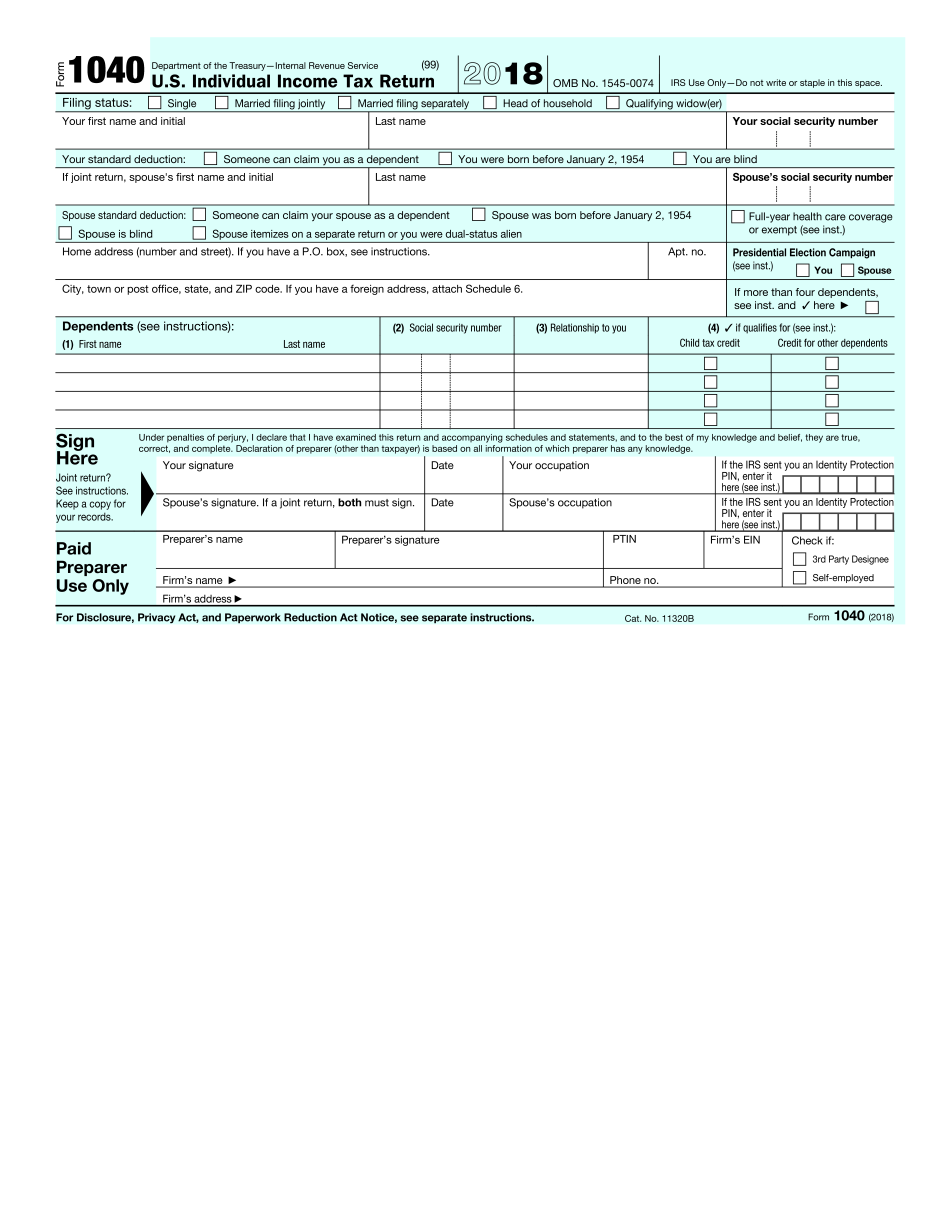

Schedule C Form 1040 For 2025. Use tax form 1040 schedule c: An crucial aspect of your tax filing process involves knowing when your individual tax return is due.

2025 tax returns are expected to be due in. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business.

Who's required to fill out a Schedule C IRS form?, File your schedule c with the irs for free.

1040 Form 2025 Schedule C Season Schedule 2025, We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)

1040 Form 2025, Schedule c is an irs tax form that reports profit or loss (income and expenses) from a business.

IRS 1040 Schedule 3 20202022 Fill and Sign Printable Template, If you’re in a partnership, you’ll report those expenses on form 1065,.

Business 1040 Schedule C 1040 Schedule C Form Fill Out Irs Schedule C, Schedule c is attached to form 1040, a form you will use to inform the irs about the profit and loss of your small business the previous year.

IRS Form 1040 (Schedule C) 2019 Printable & Fillable Sample in PDF, This is 2025 schedule c guide.

2025 Federal Tax Form 1040 Printable Forms Free Online, If you’re a sole proprietor, you’ll deduct meals and entertainment on form 1040, schedule c, line 24b.